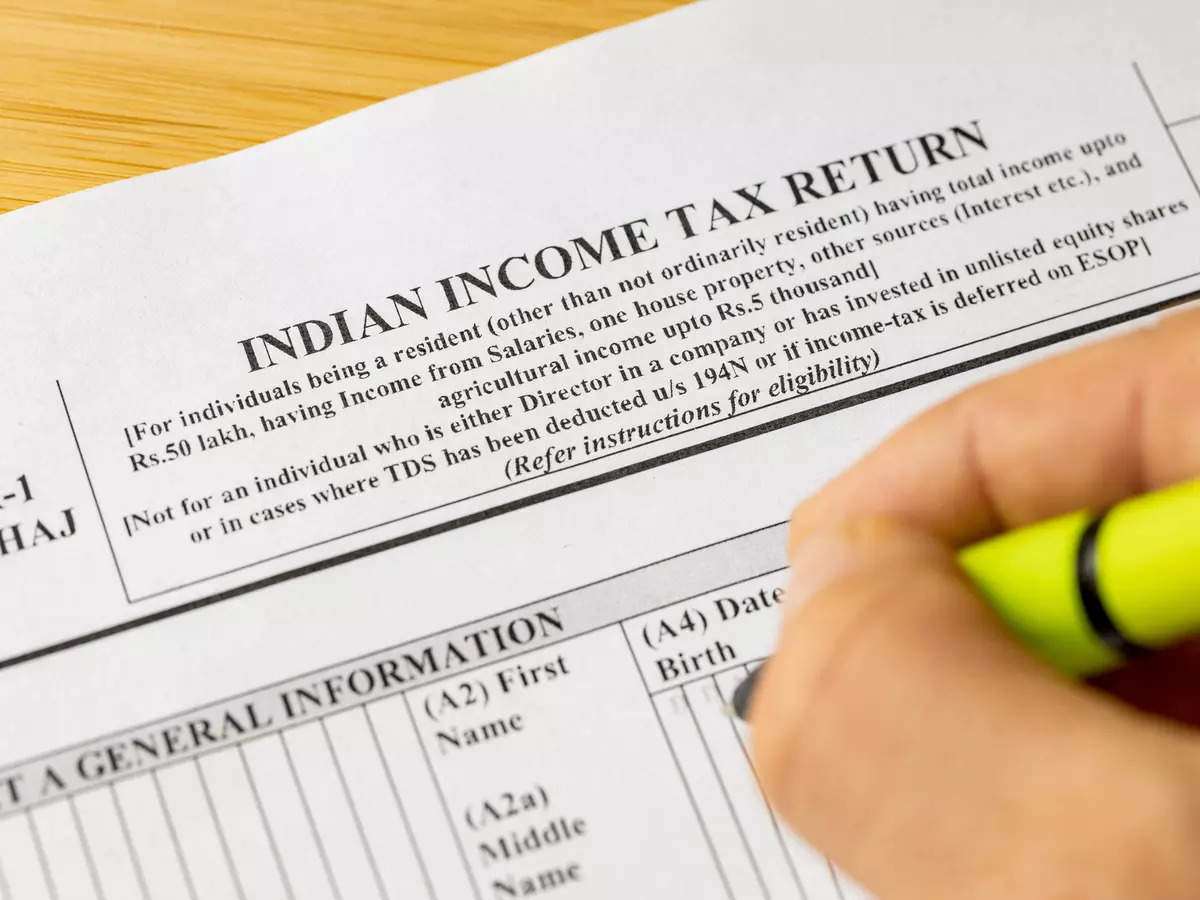

The last date to file income tax return for AY 2023-24 (FY 2022-23) was July 31, 2023. Despite asking for extension, the government has not extended the deadline for ITR filing. This is the second time that the government has not extended the deadline. Last year also the due date to file ITR was not extended.

The last date to file income tax return for AY 2023-24 (FY 2022-23) was July 31, 2023. Despite asking for extension, the government has not extended the deadline for ITR filing. This is the second time that the government has not extended the deadline. Last year also the due date to file ITR was not extended.from Tax-Wealth-Economic Times https://ift.tt/LAoDr0C