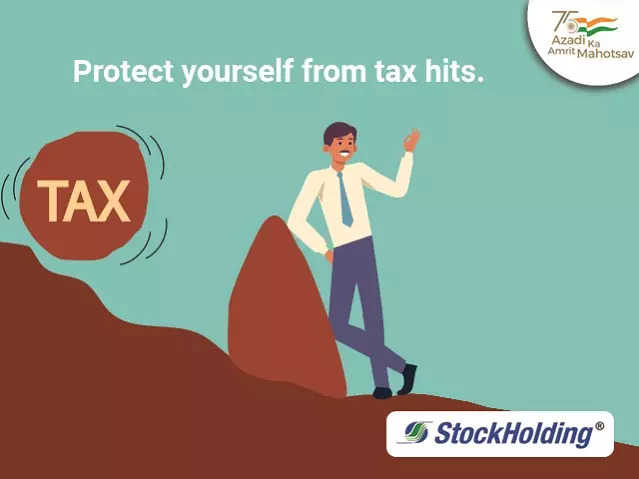

Are you a young salaried professional, whose investment and tax-saving strategy is the result of a mix of impulse and instinct, without adequate time and thought invested in much-needed planning for his taxes? While tracking the latest developments in the Indian tax landscape, we demystify the overarching differences between the old and the new tax regime to help you choose the best option.

Are you a young salaried professional, whose investment and tax-saving strategy is the result of a mix of impulse and instinct, without adequate time and thought invested in much-needed planning for his taxes? While tracking the latest developments in the Indian tax landscape, we demystify the overarching differences between the old and the new tax regime to help you choose the best option.from Tax-Wealth-Economic Times https://ift.tt/m3RXMV5