Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019.

Mody is a 1982-batch Indian Revenue Service officer, was appointed as the CBDT chief in February 2019.from Banking/Finance-Industry-Economic Times https://ift.tt/3dVT58A

Company: Garg Brothers Garg Brothers “Klassik Choice & King’s Choice” our genesis can be entirely credited to the enterprise of Shri Rahul Agarwal and Shri Ashish Kumar Agarwal. Office in Kharagpur, West Bengal, India. Products: Masala Chow used at home and there are 6 bowls each contains masala. Lachha Chow used at restaurants, hotels, hawkers, caterer and occasions & festivals.

Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk.

Since financial institutions are within the administrative control of the finance ministry, these will no doubt have early implementation. There have also been statements from the Reserve Bank governor of the nature of the ARC that will be set up. These actions portend that GoI will walk the talk. The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP).

The Union Budget 2021-22 presented in Parliament earlier this month proposed to set up a Development Finance Institution (DFI) with an initial capital of Rs 20,000 crore to fund the Rs 111 lakh crore ambitious National Infrastructure Pipeline (NIP). The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report.

The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report. "We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said.

"We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said. Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless.

Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless. "With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said.

"With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said. “Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services.

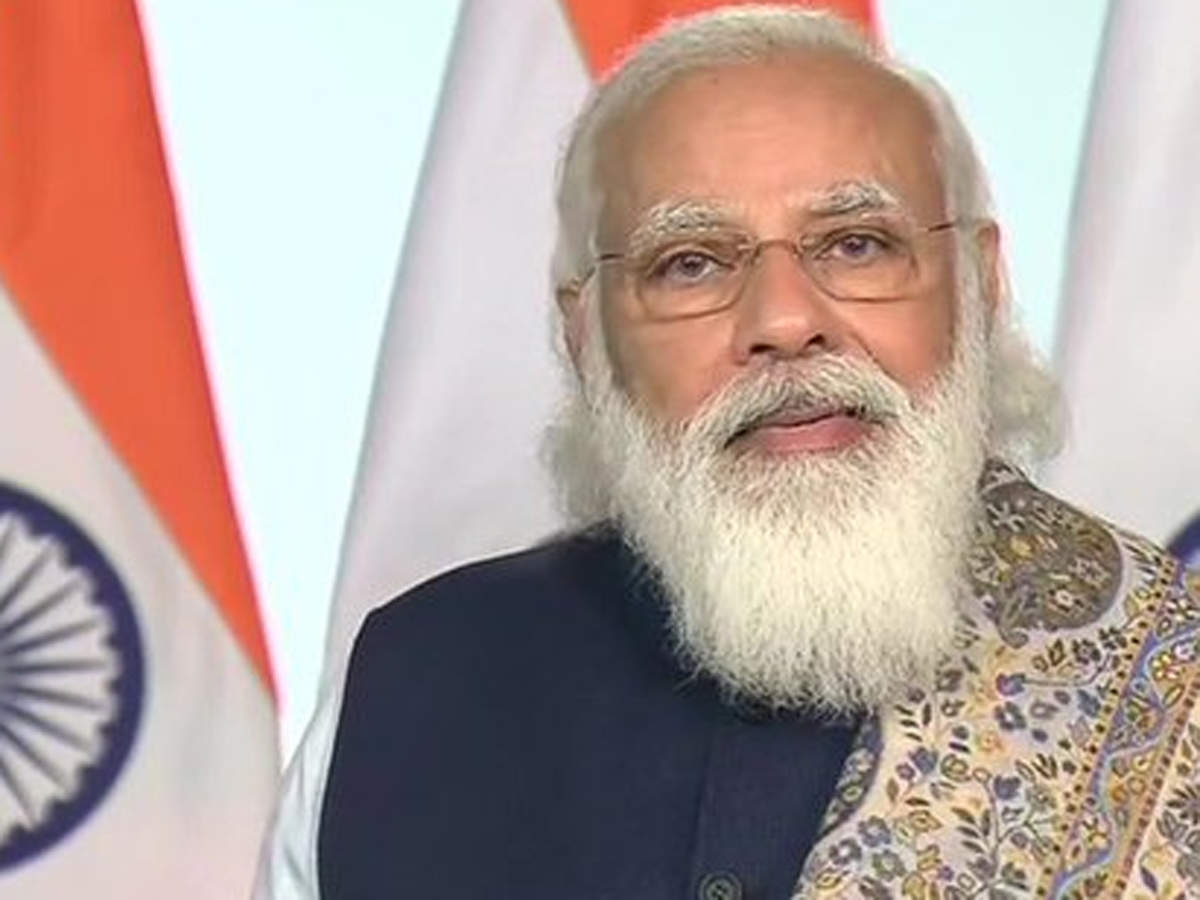

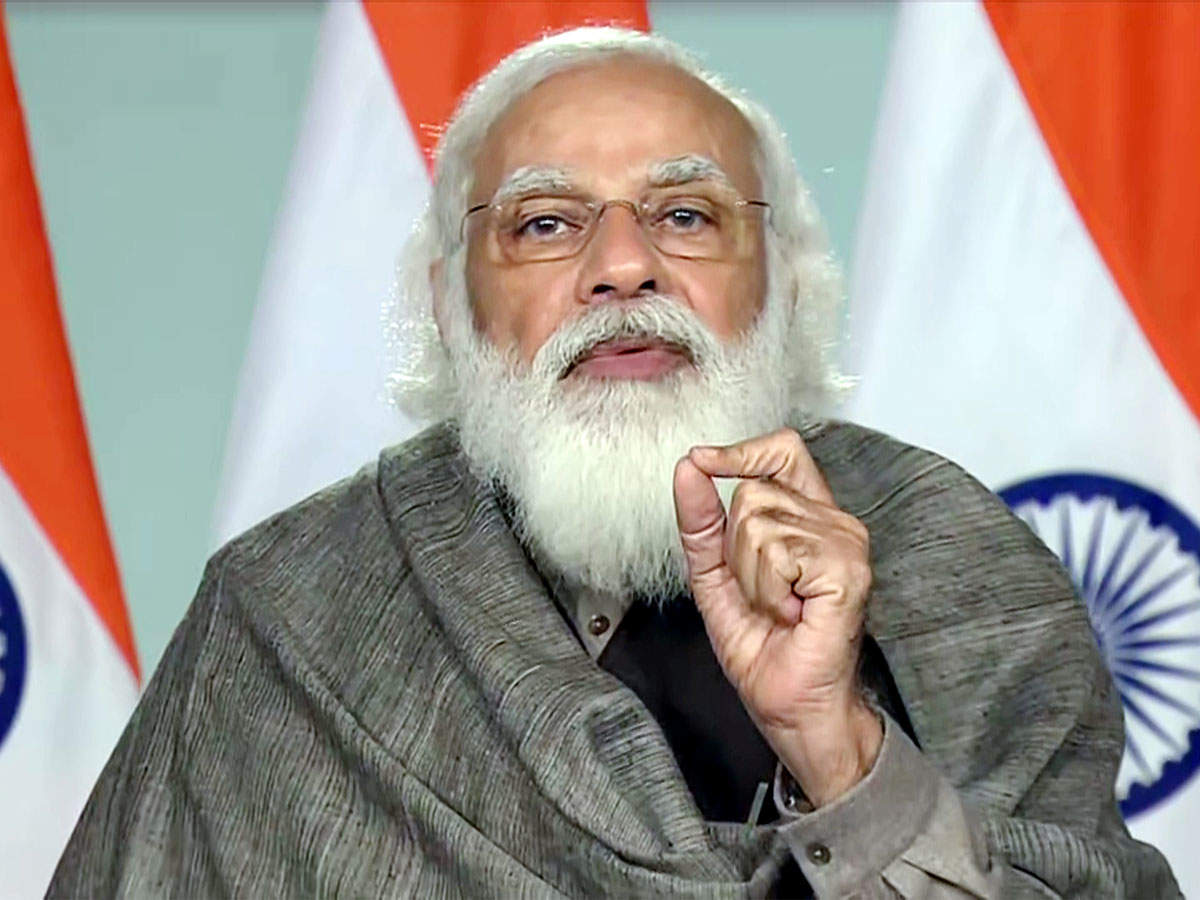

“Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services. "As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said.

"As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said. According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid.

According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid. The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too.

The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too. Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets.

Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets. The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI).

The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI). As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction.

As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction. The scheduled commercial bank, also called scheduled bank, status allows Fino to enhance its banking position in the treasury and participation in liquidity adjustment facility (LAF) window as per the RBI. It also helps the bank strengthen its business proposition on liabilities generation, Fino said in a release.

The scheduled commercial bank, also called scheduled bank, status allows Fino to enhance its banking position in the treasury and participation in liquidity adjustment facility (LAF) window as per the RBI. It also helps the bank strengthen its business proposition on liabilities generation, Fino said in a release. Bankers say that the Supreme Court moratorium over classifying loans as non performing assets (NPAs) has so far kept defaults under wraps, even as recovery efforts are ongoing. But they fear that as much as 25% loans under the scheme could turn bad.

Bankers say that the Supreme Court moratorium over classifying loans as non performing assets (NPAs) has so far kept defaults under wraps, even as recovery efforts are ongoing. But they fear that as much as 25% loans under the scheme could turn bad. "While the Indian economy is on a mend, the permanent GDP loss stemming from the brunt of the coronavirus is huge at 10 per cent. We estimate the banking system's weak loans are at 12 per cent of gross loans," S&P said. An improvement in India's macroeconomic conditions is likely to alleviate stress for the country's banking sector, said S&P.

"While the Indian economy is on a mend, the permanent GDP loss stemming from the brunt of the coronavirus is huge at 10 per cent. We estimate the banking system's weak loans are at 12 per cent of gross loans," S&P said. An improvement in India's macroeconomic conditions is likely to alleviate stress for the country's banking sector, said S&P. Paytm Payments Bank MD and CEO Satish Gupta said in a statement, "It has been our endeavour to empower our users with seamless and hassle-free travel on road. In this quest, we support our users in every possible way, including fast redressal of any grievance they face with toll plazas."

Paytm Payments Bank MD and CEO Satish Gupta said in a statement, "It has been our endeavour to empower our users with seamless and hassle-free travel on road. In this quest, we support our users in every possible way, including fast redressal of any grievance they face with toll plazas." The profit growth came despite an increase in provision for credit losses in the year dominated by the pandemic, the bank said in a statement, pointing out that money set aside for losses for wholesale advances almost doubled to USD 94 million, while the same for retail more than doubled to USD 54 million.

The profit growth came despite an increase in provision for credit losses in the year dominated by the pandemic, the bank said in a statement, pointing out that money set aside for losses for wholesale advances almost doubled to USD 94 million, while the same for retail more than doubled to USD 54 million. Its Managing Director and Chief Executive Officer Shyam Srinivasan said the increase in virus infections in states like Maharashtra needs to be watched, but exuded confidence that it will not affect the overall economic activity, terming it a "minor blip".

Its Managing Director and Chief Executive Officer Shyam Srinivasan said the increase in virus infections in states like Maharashtra needs to be watched, but exuded confidence that it will not affect the overall economic activity, terming it a "minor blip". "KFC has achieved the highest growth among the Government owned State Financial Corporations (SFCs) in India. This important achievement was facilitated by fresh loan sanctions of Rs 3385 crore so far in the current financial year," said Tomin J Thachankary, CMD of KFC.

"KFC has achieved the highest growth among the Government owned State Financial Corporations (SFCs) in India. This important achievement was facilitated by fresh loan sanctions of Rs 3385 crore so far in the current financial year," said Tomin J Thachankary, CMD of KFC. The tie up is expected to reduce SBI customers’ transaction costs and time taken for payments, sources said. Time taken to resolve cross-border payments-related inquiries can be reduced to a few hours from up to a fortnight, they said. This will help cross-border payments reach beneficiaries faster and using limited steps.

The tie up is expected to reduce SBI customers’ transaction costs and time taken for payments, sources said. Time taken to resolve cross-border payments-related inquiries can be reduced to a few hours from up to a fortnight, they said. This will help cross-border payments reach beneficiaries faster and using limited steps. “It’s quite unfortunate that the regulator has been dragging its heels on Iqbal’s appointment since the last 10 months, in fact several shareholders have even shot off letters of complaint to the RBI and the bank board about the CEO’s appointment, but there hasn’t been any response,” an official in the know said.

“It’s quite unfortunate that the regulator has been dragging its heels on Iqbal’s appointment since the last 10 months, in fact several shareholders have even shot off letters of complaint to the RBI and the bank board about the CEO’s appointment, but there hasn’t been any response,” an official in the know said. The administrator of the company received an initial report from the professional agency appointed as the transaction auditor indicating that there are certain transactions which are "undervalued, fraudulent and preferential in nature", DHFL said in a regulatory filing.

The administrator of the company received an initial report from the professional agency appointed as the transaction auditor indicating that there are certain transactions which are "undervalued, fraudulent and preferential in nature", DHFL said in a regulatory filing. Non-life insurance premium reached Rs 18488.1 crore for the month against Rs 17333.7 crore January of 2020. At 2.8% the Gross Direct Premium (GDPI) growth has been much slower for the year-to-date (YTD) period for FY21, as per data released by the General Insurance Council.

Non-life insurance premium reached Rs 18488.1 crore for the month against Rs 17333.7 crore January of 2020. At 2.8% the Gross Direct Premium (GDPI) growth has been much slower for the year-to-date (YTD) period for FY21, as per data released by the General Insurance Council. Max Life, ranked No. 4 among private players, registered a 35 per cent rise in net profit to Rs 417 crore in the nine months of 2020-21. Gross written premium were up by 16 per cent at Rs 11,912 crore, assets under management (AUM) grew by 23 per cent to Rs 84,724 crore.

Max Life, ranked No. 4 among private players, registered a 35 per cent rise in net profit to Rs 417 crore in the nine months of 2020-21. Gross written premium were up by 16 per cent at Rs 11,912 crore, assets under management (AUM) grew by 23 per cent to Rs 84,724 crore. The ruling will also set a precedent for several other IBC cases, say industry trackers. Often, the corporate lenders and the tax department are at loggerheads over who has the first right on the proceeds from the sale of an insolvent company.

The ruling will also set a precedent for several other IBC cases, say industry trackers. Often, the corporate lenders and the tax department are at loggerheads over who has the first right on the proceeds from the sale of an insolvent company.