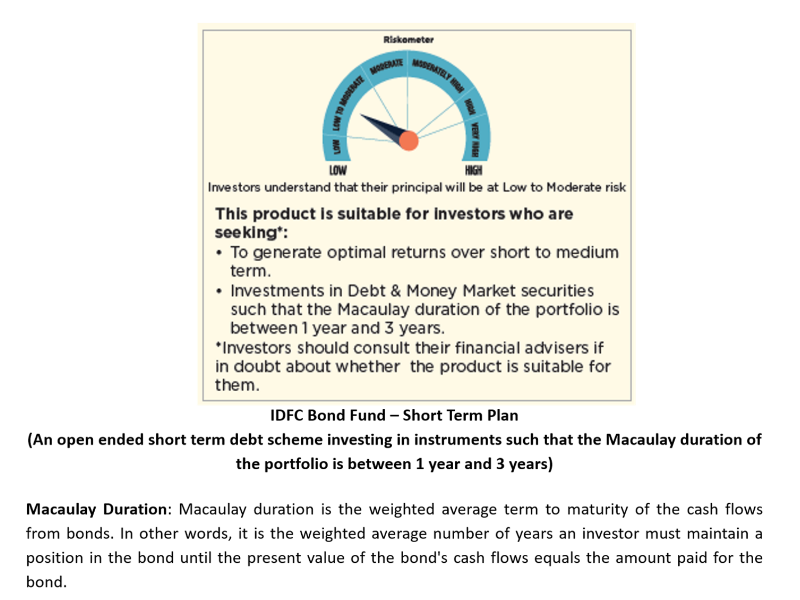

Unveiling the Budget 2021-22 in the Lok Sabha, the finance minister said the government has proposed to infuse Rs 20,000 crore into the PSBs, to further consolidate financial health of banks.

Unveiling the Budget 2021-22 in the Lok Sabha, the finance minister said the government has proposed to infuse Rs 20,000 crore into the PSBs, to further consolidate financial health of banks.from Banking/Finance-Industry-Economic Times https://ift.tt/3oIlFwc