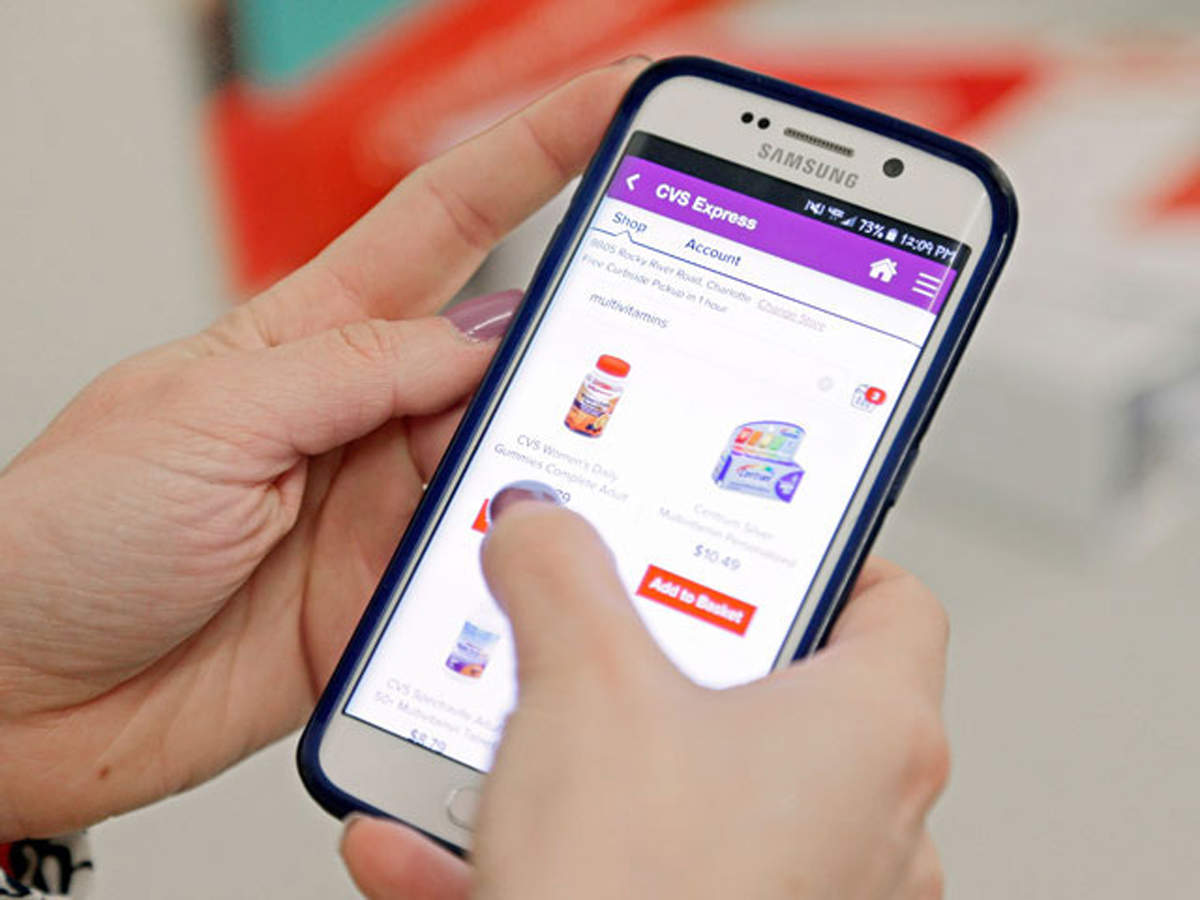

Industry experts said that while the surge in UPI-based micro-transactions could help India achieve its stated objective of transforming into a cashless economy, banks would be nervously monitoring the rising volumes of low-ticket fund transfers.

Industry experts said that while the surge in UPI-based micro-transactions could help India achieve its stated objective of transforming into a cashless economy, banks would be nervously monitoring the rising volumes of low-ticket fund transfers.from Banking/Finance-Industry-Economic Times https://ift.tt/2EL3HYT