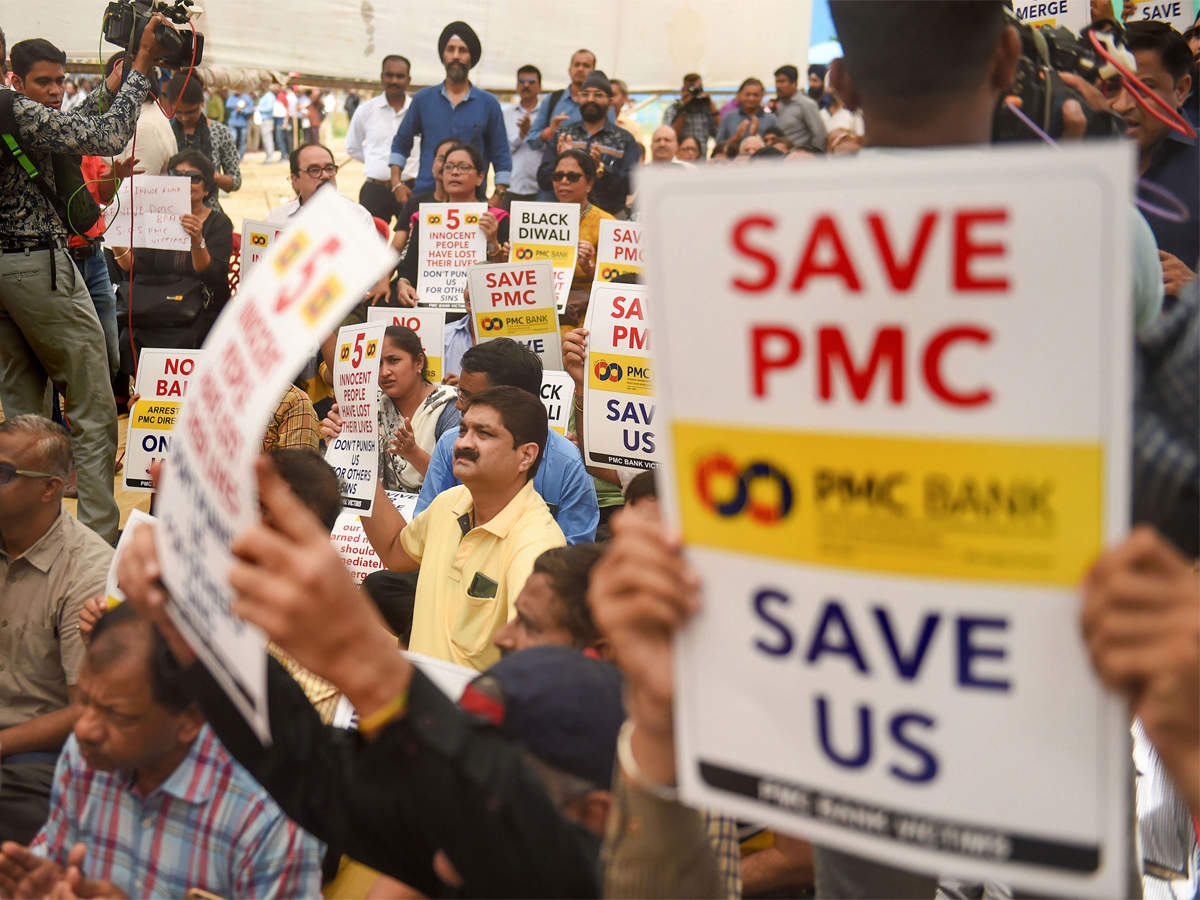

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.

The slowdown in disbursement of new credit in this period has been attributed by bankers to challenges in conducting origination activities, lack of clarity in moratorium extension and risk averseness amid tell-tale signs of stress across sectors.from Banking/Finance-Industry-Economic Times https://ift.tt/318oYme