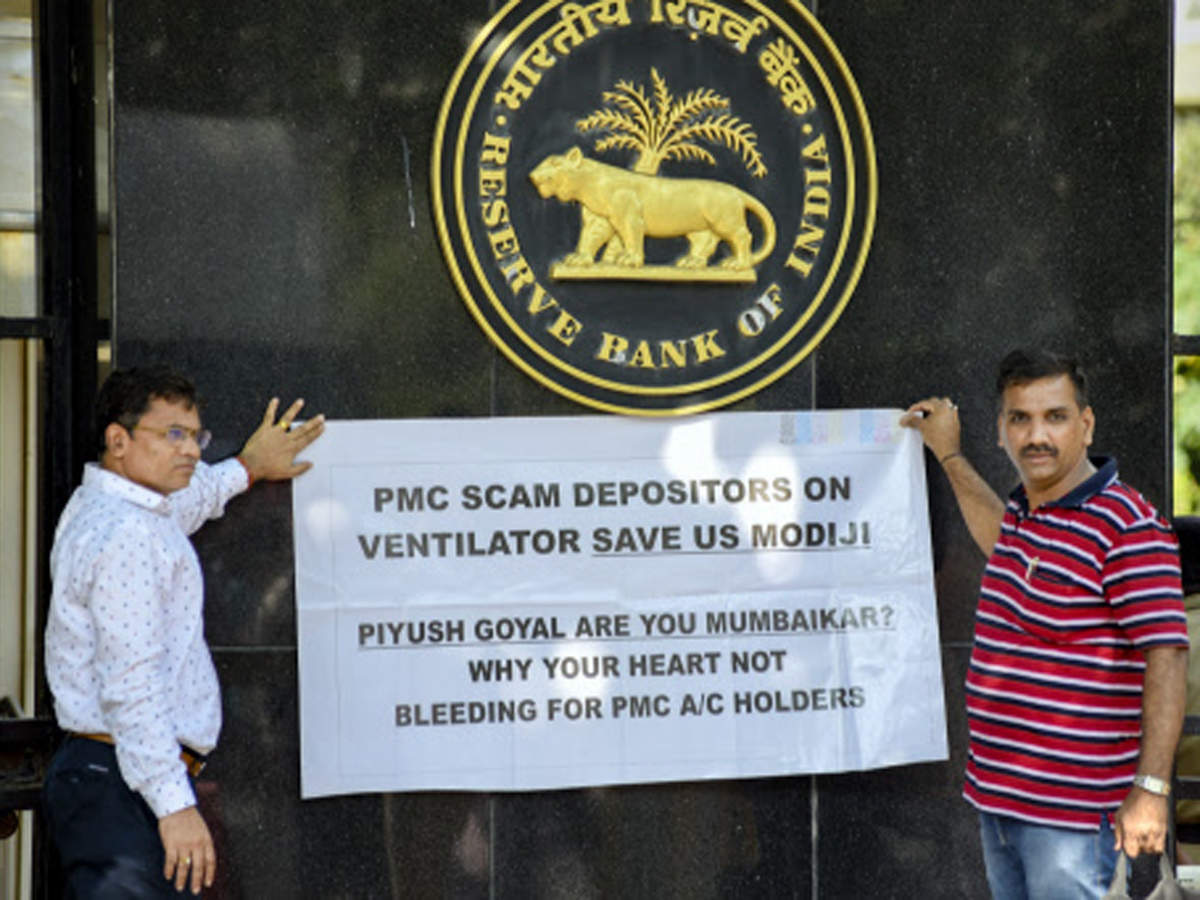

Bank credit to industry shrunk by 3.9%, or Rs 1.13 lakh crore, during the first eight months of the current financial year, according to data released by the RBI. Despite this, overall bank credit continues to be up 1% largely due to home loans and other personal loans.

Bank credit to industry shrunk by 3.9%, or Rs 1.13 lakh crore, during the first eight months of the current financial year, according to data released by the RBI. Despite this, overall bank credit continues to be up 1% largely due to home loans and other personal loans.from Banking/Finance-Industry-Economic Times https://ift.tt/2u8Zc4I